Running Payroll

Once you have decided someone is an employee you have to put them on the payroll and of course you are obligated to deduct tax and national insurance from their salaries.

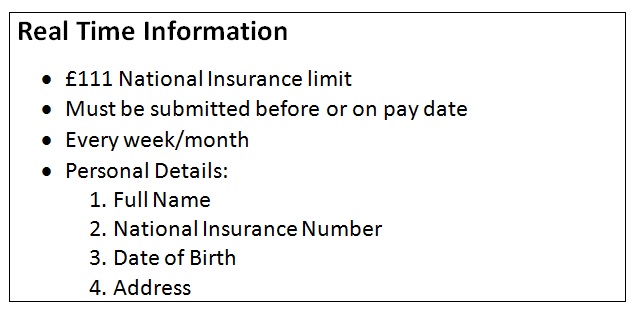

To do this you need to inform the government how much each employee earns on a regular basis by registering with HMRC as an employer and submitting RTI returns (Real Time Information). What this means is that however regular you pay your employees be it weekly or monthly you will have to file a return with HMRC stating the amounts paid and tax and NI incurred each time you make a payment. Therefor the chances are you will either have 12 or 52 returns to file each year.

The only situation where you will not be required to file such regular returns is if each and every person you employ earns less than the national insurance limit which is currently £111 per week. Unfortunately, if just one person breeches this limit throughout the year then the entire payroll needs to be registered and returns filed every week or month.

You will need some sort of software to calculate the tax and national insurance for you. We have written a separate blog on payroll software.

Other Issues

Other issues range from Pensions, Maternity Pay, Statutory Sick Pay, Student Loan Deductions and Grants.

Pensions:

Over the next couple of years the government are introducing an auto enrolment pension scheme which means that employers will have to provide employees with a pension and make contributions into that of a minimum of 1% of their salary. It is something to be aware of going forward as it will eventually affect all businesses with employees.

Statutory Payments:

Sick pay is something that you are obliged to pay. It used to be that you could claim it back off the government but unfortunately that is no longer the case. The government have introduced a £2,000 a year allowance on the national insurance that employer’s have to pay. So if your employer’s NI is anything up to £2,000 you won’t pay anything and if it is more you will only pay the difference.

Maternity and Paternity pay are also unavoidable costs. Maternity pay has to be paid for 39 weeks. The first 6 weeks at 90% of their full pay with the remaining 33 weeks at £138 a week.

Paternity pay is much shorter with the entitlement just 2 weeks at the same rate of £138 per week.

The good news is that unlike sick pay the government do subsidise the majority of maternity and paternity pays, so this is not something you will have to afford for whilst also paying for cover.

They will also give you an advance up front to cover maternity costs, if it is likely to prove a burden on your cash flow.

Student Loan Deductions:

This is something that the employee will declare on the form P46. The current rules are that it only affects you when your employees earn over £21,000 a year. At which point they have to pay back 9% of any excess over that amount. So if someone has a salary of £22,000 they will repay 9% of the 1,000 which is £90 a year, which you need to deduct from their salaries and pay back to the government.

These figures are for people who have had their loans recently, so if you are employing someone older then the rates may be different. Your payroll software should calculate this for you.

Grants:

The final point is regarding potential grants and subsidies that you may be able to claim. The Welsh Assembly runs a number of useful schemes which offer grants under certain conditions which will cover some salary costs. Examples include Jobs Growth Wales and Go Wales. Grants are mainly awarded if the position is training based, but there are other subsidies available. For instance if you employ someone who has been made redundant in the last six months, you may be able to claim help with their salary and also a large chunk of the cost training. It’s certainly something that is worth exploring when you do start employing people regularly as it could provide a very useful saving.

October 2014