Once you know you have to employ staff you will be left with a decision as to the method of administrating the payroll that best suits the organisation. The options are:

- Administer yourself using free software

- Administer yourself using commercial software

- Get someone else to do it via payroll bureau

Free Software:

The main advantage is cost !!

The disadvantages to using free software:

- Only available up to a maximum of 9 employees. Some free software has even lower limits.

- Advertising, sponsorship, pop ups occur in most of the programmes.

- Limited functionality with regards to more complicated payroll issues such as maternity pay.

- Limited scope regarding payroll reports and management information.

- Most require you to generate your own payslips and statutory forms.

Not all of those disadvantages will apply to all of the software, but once you pass 9 employees you will have to move on to paid software.

There is quite a good selection of free software to choose from, a good place to start is with HMRC’s website. A number of our clients have used HMRC own software and found it easy to use, however, there are significant restrictions with regards to number of employees, reports, payslips etc. The software will cover the minimum legal requirements and can be accessed at www.hmrc.gov.uk/payrti/payroll/bpt/newuser.pdf

There are also a number of commercial companies that provide free software. These tend to be cut down versions of their purchased software and will have a large content of adverts and recommendations to upgrade. HMRC list some that they have tested for RTI and this can be seen at: www.hmrc.gov.uk/softwaredevelopers/paye/rti-software-forms.htm

Two of their recommended are:

Other software not specifically recommended by HMRC but well recommended by various websites and users include:

- Bright Pay at www.brightpay.co.uk

- 12payltd at www.12pay.co.uk

- Key time free pay at www.keytime.co.uk

As your business expands you will probably need to upgrade to a commercial system.

Commercial Software

Again HMRC recommend some payroll providers at: www.hmrc.gov.uk/softwaredevelopers/paye/rti-software-forms.htm

Various websites also recommend Moneysoft, Brightpay, 12pay and Payroo. All of these will have different functions and costs.

Finally, there is the third option using a payroll bureau.

Payroll Bureau

A payroll bureau has one big advantage over the other options in that you will pass the work on to someone else. There is no requirement for payroll training or the purchase of software and associated equipment.

Outsourcing payroll becomes commercially advantageous when your time is limited or is better spent running the business rather than administering the payroll. You would also have access to the bureau’s expertise and relevant reports, payslips, filing of returns and calculation of monthly or quarterly payments of PAYE & NI to HMRC.

However this freeing up of time and peace of mind will come at a cost.

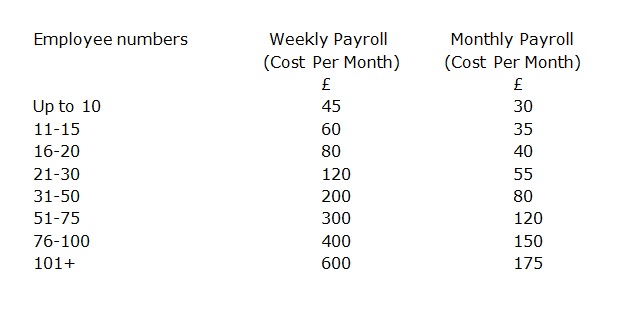

For example following is a list of our wages bureau charges:

All prices are exclusive of VAT.

The decisions as to which payroll system you will run will come down to the circumstances of the business, the business prospects going forward and the importance and value of your time.

November 2014