Employee or Self Employed

One of the decisions a business has to make is whether or not specific individuals are actually employees. This may sound like an easy question but it’s not as straight forward as it sounds.

It is quite common for business to treat someone who works for them or on their behalf as self – employed or as a freelance subcontractor. The reason being that it has many tax advantages however this can be a dangerous thing to do and should not be entered into lightly.

Unfortunately employment status is not a matter of personal preference but is based on the relationship between worker and employer. If you treat someone as self – employed who qualifies as an employee you run the risk of running up a sizeable tax and national insurance liability, plus the possibility of interest and penalties.

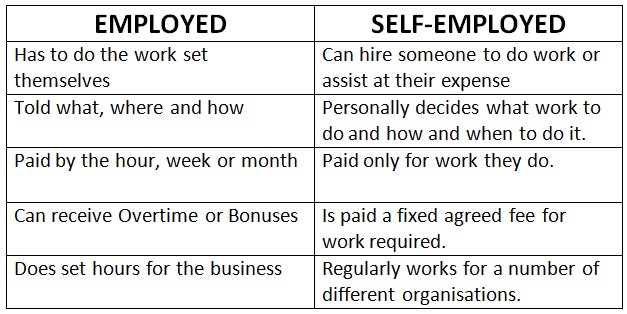

Whether someone is employed or self – employed requires a review of a considerable number of factors relating to their working relationship with you and your business. The guidelines from HM Revenue and Customs website should help you make that decision but some of the main points are:-

If you are still unsure then it is best to seek specialist advice or treat them as an employee to err on the side of caution.

If you do decide that someone is self – employed then at the very least you need to be able to show during an inspection from HMRC that you have reviewed all the facts and made a reasoned and carefully argued decision as to why that person is self – employed.

Once you decide that someone is in fact an employee there are further decisions and actions to take.

Contract of Employment

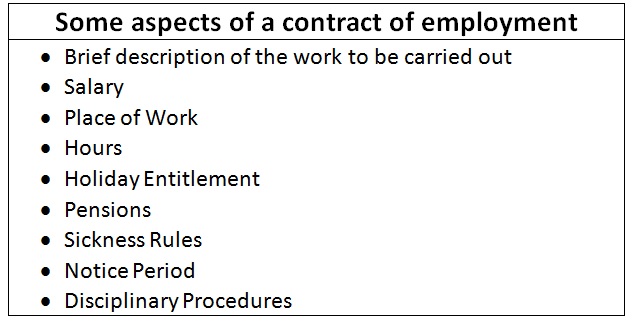

Firstly a contract of employment should be drawn up. Technically contracts do not need to be in writing to be legally binding but it is obviously far better if they are so you have something tangible to refer to in the event of a dispute.

The contents of an employment contract will vary depending on the complexities of the job but the fundamental principles should remain the same. The main things covered in a contract are listed here:-

If you require any assistance regarding contract we find that ACAS provide an extremely useful service. They have a free helpline which you can call for advice and if you access their page online there is a downloadable basic contract of employment which should be sufficient for most of your needs. It’s also a Word document, so it can be easily tailored to suit what you want.

The other document that you should get all staff members to sign is a P46. These are easily downloadable from the HMRC website and they are a declaration by the employee of whether or not they currently have or have had other employments in the tax year and also if they are subject to student loan deductions. By getting them to sign this it covers you the employer if HMRC investigate and find any problems. For instance if someone has another job then it will affect the tax code that you put them on. If they don’t tell you they have another job and you use the wrong tax code then you could be penalised, so it’s important to get them to sign this.

September 2014