The first question to ask is, are you self-employed and operating a business or are you an employee. If you are self-employed; income tax and national insurance payments are lower and you can deduct more expenses against your income. Against these benefits you have no employment law rights and more administration, self employment is not for everyone. Due to the tax savings, both employers and employees often like to say someone is self employed, but HMRC take the opposite view and would like to classify more people as employees. If you get this wrong you will be penalised by HMRC, so to assist you in the decision HMRC has published an online toolkit which we will cover in a later blog.

Once you have confirmed you are self employed there are three main basic business structures:

- Sole trader

- Partnership

- Company

Sole Trader

The most common business choice is to set up as a self-employed individual; to become a sole trader.

Features

- Simplicity – easy to set up and run. Most appropriate for the smallest of enterprises

- Minimal form filling and few compliance obligations

- You notify HMRC using form CWF1 – http://www.hmrc.gov.uk/forms/cwf1.pdf

- A self-assessment tax return is submitted annually to HMRC

Tax is paid twice yearly on the 31st January and 31st July.

Advantages

- Simplicity, flexibility

- Funds can be extracted by the owner with no PAYE obligation

Disadvantages

- Unlimited liability – personal liability for all the business debts

- Profits liable to income tax and national insurance which often result in a higher overall tax bill than the other business structures

- Limited opportunities to raise finance

Partnerships

Features

- Shares many of the advantages and disadvantages of a sole trader.

In addition:-

Advantage – Ability to share profits among members (often family members)

Disadvantage – Additional compliance obligations, an annual partnership tax return is required as well as the self-assessment return

Company

The third main type of business structure is a company which is the preferred vehicle for most businesses. If we look at the features of a company we can see why:

Features

- Limited liability

- Tax Efficient: –

- Low effective rate of corporation tax

- No income tax on dividends for standard rate taxpayer

- No national insurance on dividends

- Corporation tax paid 9 months after year end

- Corporate status – separate legal entity; own assets including any intellectual property in its own right

- Separation of owners / shareholders and management / directors

- Ability to give shares or options to investors and employees

- Alphabet shares, class A, B, C etc. can be issued to employees

- Most small companies are owned and managed by the shareholder

- The owner / manager is usually an employee of the company

An individual can run and set up a number of companies covering different businesses.

Advantages

- Tax efficient

- Limited liability

- Corporate status

Disadvantages

- Additional level of complexity and bureaucracy – additional form filling for Companies House & HMRC

- Public disclosure of accounts, directors and owners

- IR35 – if you get employed v self-employed status wrong HMRC can still treat you as an employee even if you operate through a company.

Additional cost to set up and run – although a company can now be set up for as little as £10.

There is no right or wrong answer as to which structure is best for you. Many businesses will start out as a sole trader but progress to a company, if you are starting out and anticipate low initial profits then a sole trader is right for you. If you are considering a company before you incorporate you need to get a clear understanding of the additional compliance and regulatory cost of running a company and compare it against the benefits.

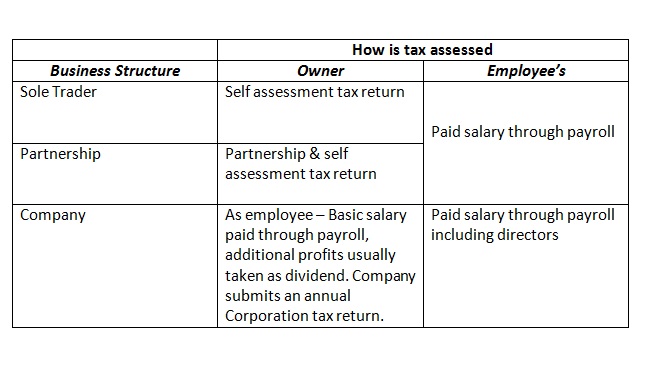

To finish off we like to look at how tax is assessed on the owner/manager and employee.

Any of these business structures can register with HMRC as an employer; companies are not the only employers. We act for sole traders and partnerships with over 50 employees, historically accountancy and law firms have acted though partnerships and they have tens of thousands of employees. Conversely for our company clients 80% are not registered as employers and do not have any paid staff.

July 2014